If you’re reading this, then you’re probably wondering the best strategy to tackle terminal leave:

Should you sell your excess leave? Is it more advantageous to use it (while collecting an active duty paycheck)?

Personally, it made more sense for me to “use it” when I separated, but your situation could be different.

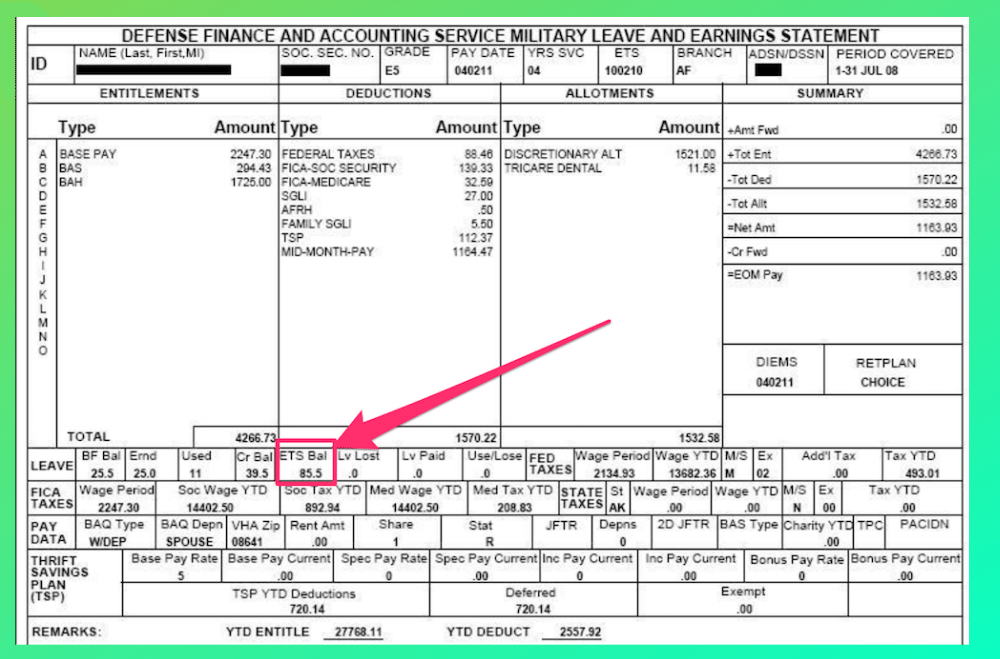

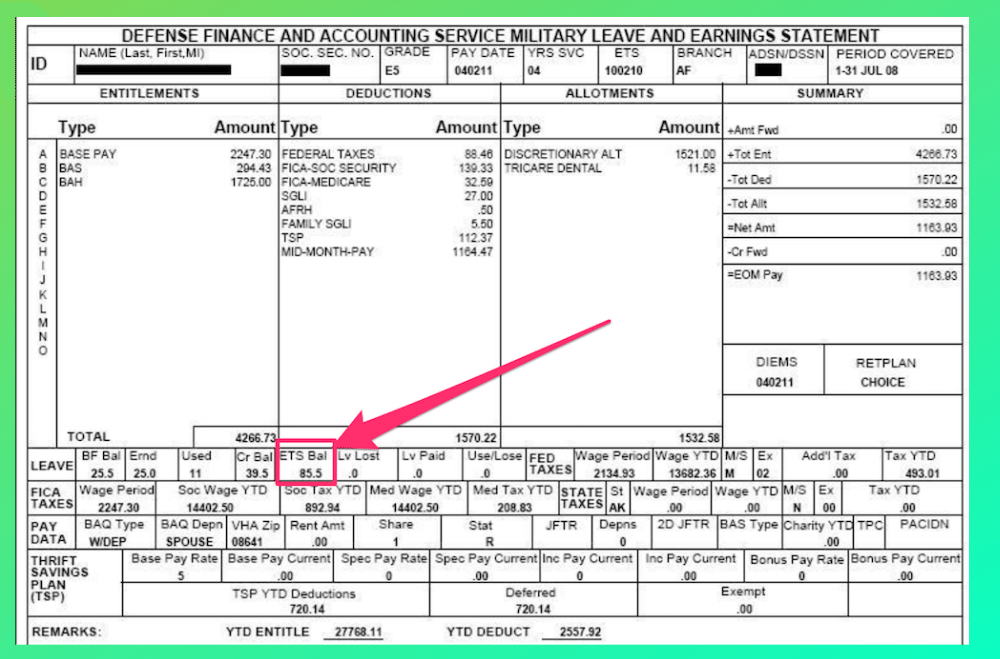

In order to calculate your terminal leave, find the block labeled ETS BAL on your Leave and Earnings Statement (LES). This block estimates how much leave you will have at your date of separation. This is your terminal leave, which is a paid leave granted immediately prior to a military member's end of service. You have two choices: 1) Use your terminal leave prior to your date of separation, or 2) don’t use it, and elect to sell it back to the military.

Want to know more about terminal leave, how it's calculated, and how much you can earn from selling back your leave? We'll explain everything to you, so keep reading!

What is Terminal Leave?

The term “terminal leave” (also called transition leave) applies to the leave taken by an active duty service member immediately prior to his retirement from service.

This leave comes from any accrued and unused leave, and is typically used to prepare for transitioning into civilian life.

Generally, active duty service members accrue 2.5 days of leave per month (or 30 days per year) which they can use for a variety of purposes.

You can carry up to 60 days of leave, before you are required to use it (or lose it) before October 1st of the year (start of the fiscal year).

You can use your terminal leave for a lot of things, from taking that vacation you have always dreamed of, to spending quality time with family and friends, and especially for looking for a job or applying for college.

When taking terminal leave, you will have to process all your documents for retirement or separation prior to the start of your leave, as going on terminal leave essentially means that you are already out of the service.

But, here’s the good thing:

Do You Still Get Paid While On Terminal Leave?

Even though a terminal leave serves as your transition into civilian life, it’s still a paid leave so you will still be receiving pay while on leave, as well as benefits such as your 401k/TSP and your health savings plan.

Is There BAH for Terminal Leave?

Additionally, you are still entitled to receive your Basic Allowance for Housing (BAH) and your Basic Allowance for Subsistence (BAS) while on terminal leave.

In this sense, terminal leave is really just like any other ordinary paid leave, except you are taking it at the end of your military career.

And by being the same as any other leave, we mean that your leave can still get terminated if your service branch needs you to report for duty, especially in the case of national emergencies.

Terminal Leave Calculator

We mentioned earlier that you can have up to 60 days of unused leave before you are required to use it before the end of the fiscal year. This also applies to your terminal leave, meaning, you can have up to 60 days (or how much unused leave you have accrued) to use as your terminal leave.

Now, if you want to approximate how many days of terminal leave you will have, here’s what you should do:

- Basing on your most recent Leave and Earnings Statement, look for your ETS balance (Expiration Term of Service), which is under the Leave section. This includes all your unused leave that you can use within the fiscal year (Cr balance), as well as the approximate amount of leave you will accrue until the end of your service.

However, this figure is based on the ETS on your contract.

So, if you are planning on an early retirement, or an extension/ renewal of your contract of obligation, then this number will change.

Alternatively, you can calculate your terminal leave this way:

- Depending on the month that you plan on starting your leave, add 2.5 days for each month you have left to your current Cr balance. For example, you are looking at your LES for August and want to take your terminal leave by December. That means you have 10 more days of leave to earn. However, you have to take into account the following:

- You may earn more leave days if you are deployed,

- If you take a leave in between now and your planned end of service, that will be deducted from your total usable leave days for terminal leave, and

- If your unused leave goes over 60 days by October 1st, anything in excess of that 60 days will be forfeited unless you use it prior to the deadline

Your approximate usable leave, therefore, will be:

- If you will take Terminal Leave within the fiscal year: Your current Cr balance + 2.5 days/ month until your planned leave month

- If you will take Terminal Leave after the fiscal year: Your current Cr balance (max of 60 days by October 1st) + 2.5 days/ month until your planned leave month

If you plan out your retirement right, you can have up to almost 3 months of leave- the perfect time to take that cross-country road trip or Carribbean cruise.

But, what if you don’t really have much use for your leave (or you’re one of those workaholics who would rather be in the service until the very last day)?

The good news is that you can opt to make money off of your unused leave by selling it back!

Here’s how:

How is Military Leave Sell Back Calculated?

Since terminal leave is just like an ordinary paid leave, you can choose to sell it back to the government, and work up to the end of your service.

Or, if you still need some time off to look for a job or to relocate after your separation from service, you can request for a Permissive Temporary Duty (PTDY) leave, which is a non-chargeable leave.

Doing so means you can earn money from your unused leave, while still getting your needed time off to prepare for civilian life.

Alternatively, you can use your PTDY in conjunction with your terminal leave. You have up to 10 days of PTDY to use at the end of your service.

In order to calculate how much you can earn for selling back your unused leave, follow this formula as a guide:

(Your daily basic pay x The amount of leave to sell back) - Your tax bracket

= Projected Sell Back Amount

Note that this is only a rough approximation of how much you can receive. The actual amounts depend on several factors, such as:

- Your actual basic pay may be less than what you expect due to deductions and withholding tax (which you can apply to get refunded the following year),

- Your tax bracket depends on your rank and length of service. However, if you are selling your leave at a lump sum, the tax will automatically be 25%, and

- Any leave accrued during any time that you were deployed (Combat Zone Tax Exclusion Leave) are tax exempt if you choose to sell

Also, you can only sell back a maximum of 60 days of leave.

The best way for you to determine how much you can earn from selling back your leave is to consult with your command’s financial counselor. He will be able to address all your concerns regarding how much leave you have, as well as how much of it you can sell (and how much you can earn from doing so).

When making the decision to use or sell back your terminal leave, here are some more factors that you have to consider:

What Are Some Factors To Consider Regarding Terminal Leave?

Using or selling back your leave should be a personal decision, as each and every case is different. Aside from figuring out how much you can earn from selling back your unused leave, as well as what you plan on using your leave for, here are some more factors that you need to take into account before you decide:

- The longer you are in the service, the higher your pay gets. You get 1/12th of 2-1/2 percent for those under the Final Basic Pay or High-3 formulas, or 1/12th of 3.5 percent, for those under CSB/REDUX, for every month that you serve after 20 years,

- As mentioned earlier, your unused leave can only be sold back for your basic pay, and this is also minus tax, which can amount to 25% if sold at a lump sum

- You are only allowed to begin civilian employment under terminal leave, and not through PTDY,

- You are required to retire at the first of the month, unless your separation from service is due to a disability, and

- If you are retiring due to a disability, your retirement date can be moved back so that you can use any transition leave that you are unable to sell because of the 60-day limit.

Another consideration is with regards to your rank.

Enlisted Military Member Terminal Leave (Use It or Sell It Back?)

If you are an enlisted military member, here are some of the things that you need to consider:

- Your tax bracket may be lower than a high ranking officer, but you still need to account for this when considering your immediate monetary needs.

- If you have been deployed, the leave that you earned during your deployment are non taxable. This means that the longer you have been deployed, the higher you can earn from selling back your leave.

- If you are going to attend school right after service, take into account whether you can get more benefits from tuition assistance or your GI Bill entitlement. Likewise, if you are starting a job, compare your salary to how much you can get for selling back your leave.

Officer Military Member Terminal Leave (Use It or Sell It Back?)

On the other hand, if you are an officer in the service, take into account these things:

- If you have been in the service for 20 years, staying on for even just a month further translates to a salary increase.

- Your tax bracket may be higher, so take this into account when trying to decide if selling back your leave is worth it.

- Additionally, also consider factors such as whether you have been deployed recently, and if you are starting a career or education immediately after retirement.

Ultimately, the decision on what to do with your leave should be one that is weighed carefully. It is best to consult with your command’s financial counselor for detailed information and advice on how to proceed.

Retirement from service means a whole new world of opportunities as an honored veteran. Find out the 29,000+ opportunities you can take advantage of as a veteran by visiting milversity.com/explore